- English

-

EnglishDeutschItaliaFrançais한국의русскийSvenskaNederlandespañolPortuguêspolskiSuomiGaeilgeSlovenskáSlovenijaČeštinaMelayuMagyarországHrvatskaDanskromânescIndonesiaΕλλάδαБългарски езикGalegolietuviųMaoriRepublika e ShqipërisëالعربيةአማርኛAzərbaycanEesti VabariikEuskeraБеларусьLëtzebuergeschAyitiAfrikaansBosnaíslenskaCambodiaမြန်မာМонголулсМакедонскиmalaɡasʲພາສາລາວKurdîსაქართველოIsiXhosaفارسیisiZuluPilipinoසිංහලTürk diliTiếng ViệtहिंदीТоҷикӣاردوภาษาไทยO'zbekKongeriketবাংলা ভাষারChicheŵaSamoa日本語SesothoCрпскиKiswahiliУкраїнаनेपालीעִבְרִיתپښتوКыргыз тилиҚазақшаCatalàCorsaLatviešuHausaગુજરાતીಕನ್ನಡkannaḍaमराठी

E-mail:Info@YIC-Electronics.com

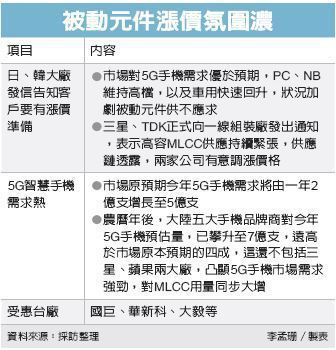

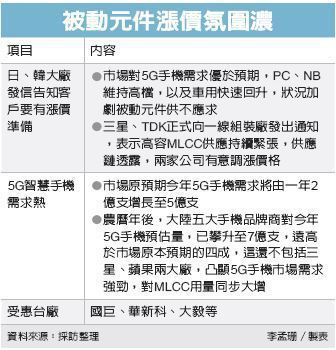

Tight supply, passive components set off a new wave of gains

The two major index manufacturers of passive component multilayer ceramic capacitors (MLCC) South Korea’s Samsung Electro-Mechanics and Japan’s TDK have recently officially issued notices to first-line assembly plant customers, emphasizing that the supply of high-capacity MLCCs continues to be tight, especially the demand for 5G mobile phones after the Lunar New Year. The estimated volume of mainland brand factories has reached the market's original estimate of 500 million units. Considering the market mechanism, the MLCC price will be increased soon.

It is reported that the visibility of Yageo and Walsin's orders is more than four months, and it will reach the second half of the year. It is expected that prices will be raised accordingly to catch up with the boom in market conditions.

Samsung Electro-Mechanics and TDK are the world's second largest and fifth largest MLCC suppliers. The two manufacturers simultaneously released information about their intention to increase prices. In addition, the leading manufacturer Nissho Murata Manufacturing Co., Ltd.'s recent average delivery period for MLCC products has exceeded 112 days, the longest It takes 180 days to highlight the hot market conditions and price increases are imperative.

It is reported that the visibility of Yageo and Walsin's orders is more than four months, and it will reach the second half of the year. It is expected that prices will be raised accordingly to catch up with the boom in market conditions.

Samsung Electro-Mechanics and TDK are the world's second largest and fifth largest MLCC suppliers. The two manufacturers simultaneously released information about their intention to increase prices. In addition, the leading manufacturer Nissho Murata Manufacturing Co., Ltd.'s recent average delivery period for MLCC products has exceeded 112 days, the longest It takes 180 days to highlight the hot market conditions and price increases are imperative.

According to industry analysts, after the Lunar New Year, the MLCC has a strong "rising sound" atmosphere, mainly because the market's demand for 5G smartphones is better than expected, and the housing economy has pushed up PC and NB shipments to maintain high-end, and automotive-related markets Pick up quickly.

In particular, some factories of the MLCC leader Nissho Murata Manufacturing have previously suspended production due to the strong earthquake in Tohoku, Japan. Although they have resumed work one after another, the market is worried that the overall output of Murata will be affected during the suspension of work. Unknown, so the active buying is also another important momentum to push up the price.

According to supply chain analysis, the market originally expected that the size of the 5G mobile phone market this year will increase from about 200 million last year to about 500 million. However, after the end of the Lunar New Year holiday, the five major mobile phone manufacturers in mainland China are chasing orders. The estimated number of 5G mobile phones from the five manufacturers for this year has reached 500 million. This does not include the two major index manufacturers of Samsung and Apple. Shipment volume shows that the overall 5G mobile phone market demand is far stronger than market estimates.

As the number of MLCCs used by 5G mobile phones has increased by 30% compared to 4G mobile phones, the five major mobile phone brands in mainland China have increased the demand for MLCC simultaneously.

The assembly plant revealed that it has recently received notices from Samsung Electro-Mechanics and TDK, which pointed out that due to the strong home demand for consumer electronics, the supply of high-capacity parts of MLCC is tight, and customers must be psychologically prepared for MLCC price increases at any time.

As market conditions become more tight, the industry believes that Taiwanese manufacturers such as Yageo and Walsin will not rule out raising their quotations in response to the strong price increase atmosphere of Japanese and Korean manufacturers. Yageo stated that it would not comment on the quotations and orders received by its peers, but would closely monitor market conditions and make the most appropriate response.

Walsin responded that the visibility of MLCC and resistor orders is currently more than four months, and customers have begun to place orders for the third quarter. It is expected that if semiconductor supply turns smoothly in the second half of the year, the shipment momentum of major terminal applications will be stronger, and the supply of passive components will be tighter. .

In particular, some factories of the MLCC leader Nissho Murata Manufacturing have previously suspended production due to the strong earthquake in Tohoku, Japan. Although they have resumed work one after another, the market is worried that the overall output of Murata will be affected during the suspension of work. Unknown, so the active buying is also another important momentum to push up the price.

According to supply chain analysis, the market originally expected that the size of the 5G mobile phone market this year will increase from about 200 million last year to about 500 million. However, after the end of the Lunar New Year holiday, the five major mobile phone manufacturers in mainland China are chasing orders. The estimated number of 5G mobile phones from the five manufacturers for this year has reached 500 million. This does not include the two major index manufacturers of Samsung and Apple. Shipment volume shows that the overall 5G mobile phone market demand is far stronger than market estimates.

As the number of MLCCs used by 5G mobile phones has increased by 30% compared to 4G mobile phones, the five major mobile phone brands in mainland China have increased the demand for MLCC simultaneously.

The assembly plant revealed that it has recently received notices from Samsung Electro-Mechanics and TDK, which pointed out that due to the strong home demand for consumer electronics, the supply of high-capacity parts of MLCC is tight, and customers must be psychologically prepared for MLCC price increases at any time.

As market conditions become more tight, the industry believes that Taiwanese manufacturers such as Yageo and Walsin will not rule out raising their quotations in response to the strong price increase atmosphere of Japanese and Korean manufacturers. Yageo stated that it would not comment on the quotations and orders received by its peers, but would closely monitor market conditions and make the most appropriate response.

Walsin responded that the visibility of MLCC and resistor orders is currently more than four months, and customers have begun to place orders for the third quarter. It is expected that if semiconductor supply turns smoothly in the second half of the year, the shipment momentum of major terminal applications will be stronger, and the supply of passive components will be tighter. .